This court has consistently ruled that penalties must not go further than what is necessary to ensure the correct collection of VAT.

Moreover, according to previous court’s rulings, in order to assess if a penalty is excessive or not, the specific context of each case, including the behaviour of taxpayers, must be considered, especially in the event of lost VAT revenue or tax evasion.

In case there is no tax loss, penalties for non-compliance with formal obligations are allowed, but these penalties should never be identical to those imposed in a context where there is a loss of tax revenue or even fraud.

It is therefore important to make a distinction between penalties for non-compliance with formal requirements and those imposed in situations where there has been a loss of VAT revenue.

Unfortunately, countries do not always respect these limits with the result that there is increasingly more jurisprudence.

Moreover, according to previous court’s rulings, in order to assess if a penalty is excessive or not, the specific context of each case, including the behaviour of taxpayers, must be considered, especially in the event of lost VAT revenue or tax evasion.

In case there is no tax loss, penalties for non-compliance with formal obligations are allowed, but these penalties should never be identical to those imposed in a context where there is a loss of tax revenue or even fraud.

It is therefore important to make a distinction between penalties for non-compliance with formal requirements and those imposed in situations where there has been a loss of VAT revenue.

Unfortunately, countries do not always respect these limits with the result that there is increasingly more jurisprudence.

France

A recent referral to the French constitutional court is dealing with this controversial topic.

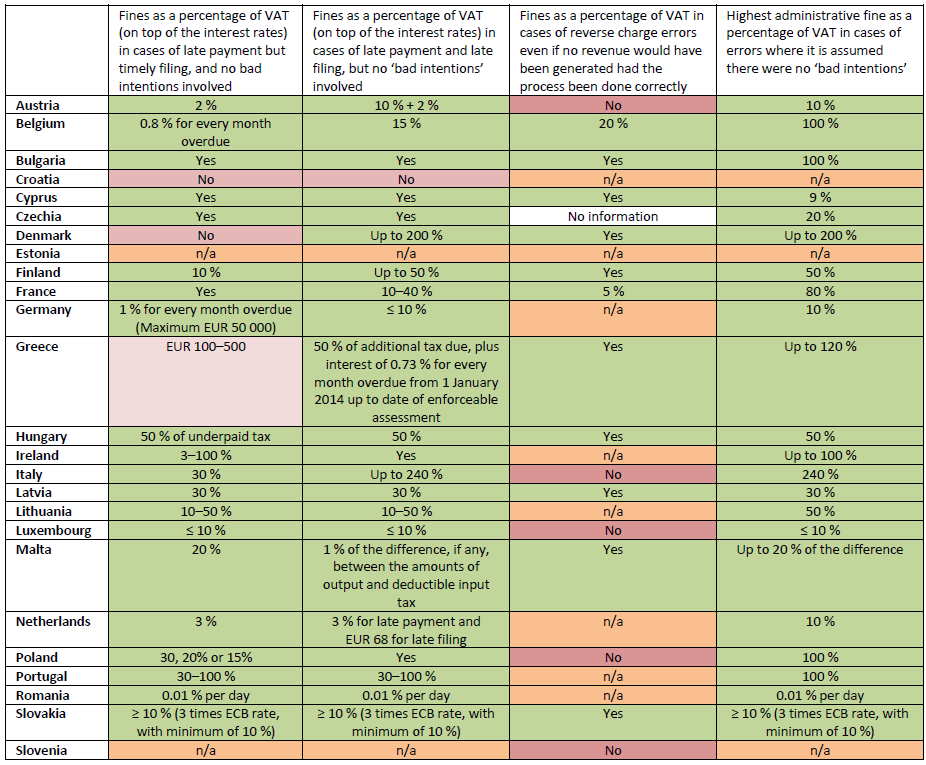

In France, pursuant to Article 1788 A 4° of the French Tax Code, the French Tax Authorities are entitled to apply a 5% penalty on the underreported reverse charge input VAT amounts. The penalties also apply when the taxpayer is entitled to full deduction and hence authorities do not suffer any VAT loss.

A French taxpayer - who was faced with an assessment - challenged this 5% penalty. The question is whether the absence of a cap for such formal errors is infringing the principle of proportionality.

The Council of State, when asked about the constitutional nature of the penalty decided to refer the matter to the Constitutional Council for a preliminary ruling (Conseil d’État, n°462398 dd. 14 juin 2022).

Belgium

In Belgium, not accounting for reverse charge VAT can result in a 20% penalty. Similar to France, these penalties apply regardless the (reverse charge) VAT deduction position of the taxpayer.

We also recently observed increased audit activity on the correct valuation of taxable VAT amounts upon import. Mistakes in this field are easily made. Also considering that customs brokers are not always including the additional costs such as freight charges in the taxable amount of import VAT when lodging customs declarations. This is even more relevant in the post Covid-19 era with booming freight charges.

A recent referral to the French constitutional court is dealing with this controversial topic.

In France, pursuant to Article 1788 A 4° of the French Tax Code, the French Tax Authorities are entitled to apply a 5% penalty on the underreported reverse charge input VAT amounts. The penalties also apply when the taxpayer is entitled to full deduction and hence authorities do not suffer any VAT loss.

A French taxpayer - who was faced with an assessment - challenged this 5% penalty. The question is whether the absence of a cap for such formal errors is infringing the principle of proportionality.

The Council of State, when asked about the constitutional nature of the penalty decided to refer the matter to the Constitutional Council for a preliminary ruling (Conseil d’État, n°462398 dd. 14 juin 2022).

Belgium

In Belgium, not accounting for reverse charge VAT can result in a 20% penalty. Similar to France, these penalties apply regardless the (reverse charge) VAT deduction position of the taxpayer.

Other penalties apply to import (reverse charge) errors. The penalty for incorrect reporting of import VAT amounts under the so-called (ET 14000) deferral license has been recently increased to 10%.

We also recently observed increased audit activity on the correct valuation of taxable VAT amounts upon import. Mistakes in this field are easily made. Also considering that customs brokers are not always including the additional costs such as freight charges in the taxable amount of import VAT when lodging customs declarations. This is even more relevant in the post Covid-19 era with booming freight charges.